Pundits were quick to describe Donald Trump’s decisive victory in the presidential election as a tectonic shift in American politics – a dramatic move to the right. But Wall Street seems to believe that this support stops at the voting booth, and Trump supporters won’t necessarily trust MAGA-friendly media and marketers with their hard-earned dollars.

Consider investors’ reactions to the publicly traded companies we track: Truth Social parent Trump Media and Technology Group (TMTG), social video platform Rumble, e-retailer PublicSquare, and radio power Salem Media.

Stock prices for all four declined between Election Day and November 15 – a period when the overall market was up 2.7 percent. While the companies have different stories, each recently released a financial report for the third quarter that reminded investors of their significant operational weaknesses.

Wind…or Hot Air?

To be sure, the CEOs did their best to refocus Wall Street’s gaze on Trump. They want investors to believe that, whatever their financial numbers show now, their time has come – the election revealed a nation filled with MAGA fans who are eager to support like-minded companies in a new parallel economy.

“The world is forever changed and Corporate America is going to change with it,” Chris Pavlovski – CEO of controversial rightwing video platform Rumble – told investors a week after the election. “Our courageous employees helped change the course of history.”

Michael Seifert, CEO of rightwing e-retailer PublicSquare, had a similar take. “We feel like we have wind in the sails,” he said. “We feel like we have fresh energy as we head into 2025.”

If so, then they’d better translate those words into numbers. At this point, none of them – including the president-elect’s own company – can boast of a Trump-like victory.

Trump Media and Technology Group (TMTG)

You could tell how bad the company’s report was going to be by the timing of its release: late afternoon on Election Day – a time when investors had already begun to pay more attention to Steve Kornacki’s big board than their computer screens.

But they caught up. TMTG shares lost 18.1 percent of their value between Election Day and this past November 15. That was a rare bit of bad news for the president-elect, who owns nearly 53 percent of the outstanding shares.

Easy to see why investors turned so sour. Truth Social sold a measly $1 million worth of advertising in the September quarter, down 5.6 percent from the same period in 2023. If it can’t sell ads at a time when its main attraction – Trump – is in the national spotlight fighting for his political life, then when can it?

The company report attributes the fall to “a change in a revenue share agreement with one of our advertising partners” that had been designed to help TMTG before March when it went public in a deal that provided it with $233 million.

Still, the poor performance makes it easy to wonder how long Trump will want to stick around. His new BFF, Elon Musk, controls a far bigger and time-tested platform: X.

Trump is contractually obliged to post non-political messages exclusively on Truth Social; they can appear on other platforms after six hours.

But he can go elsewhere if “in his sole discretion” he deems his comments to be political. Indeed, TMTG acknowledges that it “may lack any meaningful remedy” if Trump “minimizes his future use of Truth Social and/or broadly construes the definition of Political Related Posts.”

What’s more, he can scrap his exclusivity obligation as early as March.

WWED – What Will Elon Do?

Would Musk, the world’s richest man, be willing to buy TMTG – especially as he sees millions of X users, fed up with the platform’s blasé acceptance of disinformation, flee to competitor Bluesky? Trump’s company has a market value of about $6.1 billion, and you can be sure no antitrust official in the new administration would question a deal.

It’s anybody’s guess. Musk probably would have no problem accepting a key term in Trump’s current arrangement with Truth Social. The company has no recourse if the president-elect does anything that “could negatively reflect on TMTG’s reputation or brand or be considered offensive, dishonest, illegal, immoral, or unethical.” Indeed, the company “expressly acknowledges the controversial nature of being associated with President Donald J. Trump and the possibility of any associated controversies affecting TMTG adversely.”

Rumble

CEO Pavlovski told analysts last year that the 2024 election would be the right wing social video platform’s Super Bowl. “Now,” he says, “I can say we won the Super Bowl.”

Investors seem to think it’s a little early to spike the ball in the end zone. Rumble’s stock is down 2.8 percent since the election.

Still, Pavlovski cheerleads the Election Day performance of Dan Bongino – a commentator who said in 2018 that his “entire life right now is about owning the libs.” He had a record 515,000 concurrent viewers. In addition, Steven Crowder – who moved to Rumble last year following dust ups with Fox News and The Daily Wire – “notched a personal best” with 460,000 concurrent viewers.

Big Brand Dream

Pavlovski is most excited about his next milestone: the possibility of finally landing high-spending, big brand advertisers to the platform that has mostly relied on lower-priced direct-response ads as well as fees from subscribers to its premium tier.

He sees Trump’s victory as a turning point. “The American people have spoken,” he said. “Cancel culture is dead. Free speech is now mainstream and rolls in [Rumble’s] driver’s seat with the best lineup of independent creators with the best economics.”

Rumble’s third quarter numbers suggest he still has ground to cover.

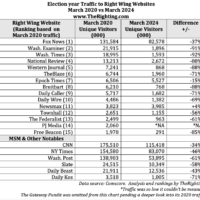

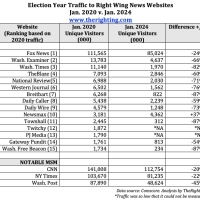

The company had 67 million average global monthly active users – a fine, election-assisted bump from 53 million in the June quarter. But it is just equal to the number it reported at the end of 2023. And it’s still below the high of 80 million it reported at the end of 2022.

Meanwhile, Rumble generated an average of 33 cents in revenue per user, down 11 percent from the June quarter and equal to the number from a year ago.

All told, the company saw its net loss increase 8.7percent to $31.5 million despite a 39.3 percent increase in revenue to $25.1 million. The culprit: an $8.2 million drop in the value of the warrants it offered investors in 2022 when it went public.

Salem Media Group

The enterprise that calls itself “America’s leading multimedia company specializing in Christian and conservative content” saw its prayers mostly unanswered in the third quarter.

Salem’s stock price is down about 2 percent since the election. It trades over-the-counter for about 25 cents a share since it failed to meet NASDAQ’s marketplace’s requirement for companies on its exchange to keep their stock prices over $1.

The company did its part for Trump by investing $1.5 million in Dinesh D’Souza’s September movie release: Vindicating Trump. The film was billed as an examination of “the various forms of ‘assassination’ faced by Trump—from character and political to legal assaults, and even an attempted physical assassination.”

The film generated $1.4 million in ticket sales at 813 movie theaters before mid-October when it moved to the SalemNOW streaming service.

“Prior to this critical election, it’s a privilege for SalemNOW to offer our viewers such an important film from Dinesh D’Souza,” the platform’s General Manager, Robert Ellis, said.

That’s a remarkable statement considering the embarrassment Salem suffered from its previous movie partnership with D’Souza. The company withdrew 2000 Mules in June and apologized to a Georgia man who the movie wrongly accused of engaging in illegal voting activity in 2020.

Tuning Out

Even more embarrassing, at least from a business perspective, is how badly Salem is doing in its core operation: radio. The stations that Salem currently owns generated $45.9 million in revenue, which is 3.4 percent less than they saw in the period last year.

That’s surprising. Stations usually see ad sales grow in election years. And Salem should have been especially popular with its line-up of Trumpy broadcast and digital stars including Sebastian Gorka, Jenna Ellis, Charlie Kirk, Dinesh D’Souza, Dennis Prager, and Hugh Hewitt.

But political campaigns and interest groups only spent about $700,000 for Salem’s radio stations and syndicated shows. That was no match for the $1.6 million drop in other ads which Salem says reflects an industry-wide drop in “time spent listening, particularly on AM radio stations.”

Making matters worse, Salem’s same-station broadcast expenses rose 3.9 percent vs. the period in 2023 due to increases in marketing, health insurance costs, programming, and music licensing fees.

The one saving grace for the quarter was that Salem didn’t have a $35.1 million write-down in the value of its assets, the way it did last year. As a result, the company ended up losing $6.6 million, an improvement from last year’s $31.3 million loss, on revenues of $58.7 million, down 7.5 percent.

Saddled with nearly $167 million in long-term debt, Salem continues to unload assets. In September it sold a building in Honolulu while it waits to close deals for stations in Little Rock.

PublicSquare

The e-retailer’s biggest strength at its launch was its clear vision of itself as a driver of a parallel economy for consumers who value “life, family, and freedom.”

But the company’s business, and prospects, have become murky over the last few months. That contributed to a 22.9 percent drop in its stock price since the election, with shares touching a new low on November 15.

PublicSquare’s Q3 report disclosed that it cancelled a $1 million one-year advertising deal with “an independent media company … on a national platform.” In October 2023 PublicSquare announced with great fanfare that it had a one-year ad agreement with Tucker Carlson’s Last Country Inc. CNBC said it would be a “seven-figure” deal.

And early this month PublicSquare disclosed a plan to lay off about 35 percent of its staff while top execs agreed to slash their compensation by double digit percentages. The announcement added that the company “may incur additional costs not currently contemplated.”

Most new companies experience growing pains. But in this case the problems seem to flow from weakness at its original B2C alternative to Amazon and Target where retail participants have to swear fealty to MAGA-friendly values. Third quarter revenues in that business fell 18 percent vs. the period last year.

It’s also fast becoming a sideline. The PublicSquare e-retail market generated just $718,000 in the quarter, a mere 11 percent of the company’s $6.5 million in revenues.

Babies and Guns

The rest of the cash came from businesses PublicSquare acquired. About 40 percent was from a diaper and wipes company that targets churches and pro-life groups. And 49 percent came from a firm acquired in March that specializes in buy-now-pay-later financing for gun sales.

With this cradle-to-grave focus, PublicSquare is “shifting our customer acquisition strategy to more of a B2B model” CEO Seifert says. Consumer-facing sales will drive additional business for its buy-now-pay-later technology.

For PublicSquare it’s buy-now-profit-later. The gun financing company deal colored the Q3 numbers. Including acquisition costs, they showed a 13.2 percent increase in the operating loss to $14.7 million even as revenues more than tripled to $6.5 million.

Executives also noted that they found “material weakness” in the way PublicSquare reported its finances. The company hired outsiders to help clean things up.

Investors were unimpressed. PublicSquare’s stock price fell about 20 percent since the election, and touched an all-time low on November 15th.

Seifert hasn’t given up on his parallel economy messaging. He calls PublicSquare “the economic manifestation of the [Trump and GOP] electoral victory.” He added that “we don’t feel like a sidebar economic actor. We feel like we really represent the mainstream American viewpoint.”

As a practical matter, he’s excited to know that “we have an administration coming into office in 2025 that seems to value [gun and ammo sales] with greater affection.”

Let’s see if he wastes his shot.

Right Wing Biz Watch is an ongoing series of articles examining the business and finances of right wing media. Its author, David Lieberman, covered the media business full time for 30 years at USA Today and other publications before joining The New School as an Associate Professor in its graduate Media Management program.