Right Wing Biz Watch

Is There Moola in MAGA? Maybe Not, Says the Market

By David Lieberman, January 9, 2024

Wall Street had discouraging news for right wing media companies at the end of 2023. The smart money believes that they need strong business models, not just fealty to Donald Trump or a religion, to make them investable.

Last year provided the first meaningful test of the proposition that there’s big moola in MAGA. Investors had opportunities to bet on three hard-right digital start-ups – Digital World Acquisition Corp. (DWAC), Public Square, and Rumble – along with familiar traditional media players on the far right: Fox Corp. and Salem Media Group.

But the five companies’ collective value shrank 13.7 percent over the last 12 months, equal to a paper loss of $2.6 billion, based on data from TradingView.

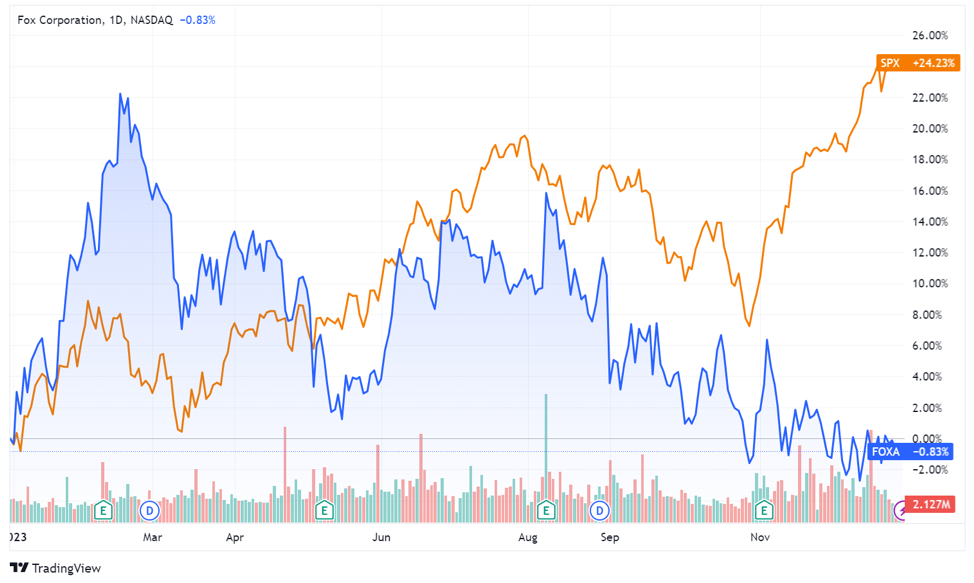

Their anemic performance stood in stark contrast to the rest of the market. The benchmark Standard & Poor’s 500 appreciated 24.2 percent, leaving it close to an all-time high.

Stock prices fell for four of the five media companies. The exception was DWAC — the special purpose acquisition corporation (SPAC) that’s angling to merge with Trump Media and Technology Group (TMTG), the parent of Truth Social. It grew, but not as much the overall market.

To be sure, 2023 was a tough year for most media companies. Still, DWAC, e-retailer Public Square, and video social media platform Rumble claimed to have a powerful competitive advantage over their rivals – they could appeal to millions they said are eager to shift their time and money to a new “parallel economy” that caters to Trump supporters and the highly religious.

Perhaps, but the stock performances suggest investors won’t share their zeal until they see more evidence. Here’s how 2023 shaped up for each of the five companies, and what’s ahead for 2024.

Digital World Acquisition Corp.

Stock price change: +16.7 percent

It’s a surprise to see DWAC still standing with hopes to merge with Donald Trump’s TMTG in early 2024. That could funnel $875 million to the owner of Truth Social.

For much of 2023 the company faced a September 8 deadline to either make a deal or liquidate, returning its funds to its shareholders. Liquidation seemed most likely as the Securities and Exchange Commission investigated insider trading charges and company excuses for its late and misleading financial reports.

DWAC put out each of its fires.

In March, it announced that it had “terminated” Chairman and CEO Patrick Orlando — who represented a subsidiary of DWAC’s biggest shareholder, Shanghai-based investment bank ARC Group.

The big change for investors came in July when DWAC settled the SEC investigations by agreeing to pay an $18 million penalty if it closes a deal with Trump, or anyone else. (The Justice Department charged three people with insider trading of DWAC shares. All three pleaded not guilty.)

DWAC also hired a new accounting firm and, in September, won shareholder approval to take an additional year to make a deal and avoid a forced liquidation.

The company still must win over investors, including owners of its preferred stock. The first peek they’ve had at Truth Social’s business did little to reassure them. TMTG generated just $3.4 million in revenues in the first nine months of 2023 – far less than its $13.9 million in operating costs.

The numbers that stand out, though, are TMTG’s $37.7 million in interest expenses on its debt, which account for the bulk of its $49 million net loss for the period. That suggests why Trump may be as highly motivated as DWAC is to make a deal. TMTG probably can’t pay lenders back without one. Many agreed to take shares in a merged company in return for the money they laid out.

If there’s no merger, TMTG said that as of September 30 it had “substantial doubt” about its ability to make all of its debt payments. It added that “it may be difficult to raise additional funds through traditional financing sources in the absence of material progress toward completing its merger with Digital World.”

Fox Corp.

Stock price change: -0.8 percent

Rupert Murdoch has a keen sense of timing. So it’s easy to imagine why he decided 2023 was the right moment to become Chairman Emeritus of Fox Corp. – the parent of Fox News.

The infotainment service for mostly old (median age 68) right-wing TV viewers, which accounts for the bulk of Fox’s profits, was humiliated and looking worse for wear in 2023. Total day viewing dropped 18 percent to an average of 1.22 million while primetime fell 20 percent to 1.85 million.

In the advertiser-favored demo of 25-to-54-year-olds, Fox News was down 38 percent to a meager 212,000.

Rivals CNN and MSNBC were also down, but not as much.

Murdoch’s not responsible for the cord cutting that weighs down all cable channels. His justifiable decision to cut Tucker Carlson, Fox News’ highest rated prime time host, probably also hurt ratings a little. But Fox’s market value fell $1.7 billion to $13.8 billion in part due to his indifference to the daily diet of far right lies and conspiracy theories on Fox News.

The channel promoted the big lie that the 2020 election was stolen from Trump, fanning the right wing flames that led to the attack on the Capital on January 6, 2021 and ultimately costing Fox $787.5 million to settle Dominion Voting Systems’ defamation suit.

Murdoch waved the white flag after the voting machine firm exposed private emails and text messages that showed he and other company leaders – fearful of driving confirmation needy viewers to other right wing services – looked the other way while Fox News hosts and guests falsely alleged that Dominion had finagled ballots to help Joe Biden in 2020.

Fox may have to endure more disgrace as another voting machine company, Smartmatic, gears up its $2.7 billion defamation suit. Wells Fargo analyst Steven Cahall figures Fox will have to shell out at least another $700 million to settle the case.

Ripple effects from the company’s journalistic malpractice are harder to quantify, but still important. A group that includes former Fox executive Preston Padden is urging the Federal Communications Commission to find the Murdoch family unfit to hold a TV station license.

Meanwhile, investors fear that Fox News makes the company too radioactive to be a significant player in 2024’s likely media consolidation sweepstakes. Last year large shareholders in Wall Street Journal parent News Corp. forced Rupert and Fox CEO Lachlan Murdoch to back away from their plan to merge the companies.

Fox’s timid board hired a law firm to recommend whether it needs to create a highly unusual special risk oversight committee.

Rupert told Fox shareholders in November that he yearned “to be remembered, if I am at all, as someone who was a catalyst for change for the good.” The revelations of 2023 made it clear that the legacy he seems to crave is one thing even this billionaire can’t afford.

Public Square

Stock price change: -47.3 percent

Investors were intrigued in July when Public Square became a publicly traded company following its merger with a SPAC, Colombier Acquisition Corp. founded by Daily Caller contributing editor and minority owner Omeed Malik.

The e-retailer, listed as PSQ Holdings, bills itself as a centerpiece in a parallel economy for “pro-American consumers” and “small and medium-sized businesses with values like well-known names such as Rumble, Black Rifle Coffee, Chick-fil-A, and In-n-Out Burger.”

“Americans are wanting to support businesses that align with their values as corporations become a politicized and divisive environment,” 28-year-old founder, president, CEO, Chairman of the Board and majority stockholder Michael Seifert told investors last month.

The way he and his compatriots see it, companies including Amazon, Budweiser, Disney, Starbucks are “politicized and divisive” when they promote choice, diversity, and accuracy – and Public Square isn’t when it lectures about the evils of abortion, LGBTQ representation, and editorial judgements to limit falsehoods, conspiracy theories, and hate speech.

The former marketing and PR specialist with a B.A. in Political Science and International Relations from Liberty University says his values come from “Jesus Christ, the way, the truth, and the life.”

Many investors initially seemed to be true believers in the business. Shares in Colombier that sold for about $10 apiece before the merger with Public Square briefly soared to more than $35.

But buyers lost faith as they saw its performance.

It generated just $2.9 million in revenues in the nine months ending on September 30 – far less than its $28.6 million in operating expenses. After including financial liabilities and interest expenses, the company reported a net loss of $47.6 million.

In the third quarter about 57 percent of Public Square’s sales were for a line of disposable diapers and wipes from EveryLife, a company it bought early in the year. The baby products subsidiary says its business decisions are “grounded in our faith in Christ and the truth of the Gospel.” The rest of Public Square’s revenues come from ads on its directory that leads consumers to retailers who share its views.

Despite the red ink, lots of cash sloshes through the company. That’s partly due to “a material weakness” accountants found in Public Square’s financial reports. Fixing it, the company said in November, “will continue to be time consuming and costly, and place significant demands on our financial, accounting, and operational resources.”

Public Square pays Malik’s Farvahar Capital $960,000 a year, plus expenses, to help Seifert with “our capital markets strategy, acquisition strategy, investor relations strategy and other strategic services.” Nick Ayers, a board member who previously served as chief of staff for former Vice President Mike Pence, collects another $360,000 a year – plus a slug of stock options – for his consulting work.

Public Square also agreed to pay $1 million for a year’s worth of ads on Tucker Carlson’s new streaming service – another project Malik supports.

Still, Seifert expects his company to have its first cash-flow positive quarter in 2024. He envisions harnessing consumer data to help the company sell a broad array of private label products, provide Amazon-like one-stop shopping and fulfillment services, and what the company calls B2B Offerings and Adjacent Services.

Rumble

Stock price change: -24.5 percent

Rumble CEO Chris Pavlovski calls the 2024 election year “our Super Bowl.” But Wall Street seems skeptical that his ad-supported, hard right, YouTube-like video infotainment platform will emerge with a championship ring.

The stock price steadily declined over the summer before plummeting 39 percent in September when a lock-up period expired for inside investors in CF Acquisition Corp. VI — the SPAC that merged with Rumble in 2022. That enabled them to finally sell their shares.

“When the lock-up is lifted, it will become evident who truly stands for free speech and who has other motivations,” CEO Chris Pavlovski said as he vowed to keep his shares.

Investors with “other motivations” noticed that his idea of free speech is shockingly expensive. He cut deals with MAGA and conspiracy-friendly commentators including Steven Crowder, Donald Trump Jr., Kimberly Guilfoyle, Dilbert creator Scott Adams, DJ Akademiks, Robert F. Kennedy Jr., and Dinesh D’Souza.

Rumble lined up social media-driven sports including Power Slap Nitro Rallycross Racing, Bare Knuckle Fighting, and UFC. And it bought podcast company Callin in a stock deal with tech investor David Sacks, a major donor to presidential campaigns for Ron DeSantis and Robert F. Kennedy Jr. and opponent of U.S. support for Ukraine.

Operating costs for the first nine months of 2023 came to nearly $159 million – more than half for programming and content. That far exceeded Rumble’s $60.6 million in revenues mostly from advertising, including availabilities it sells for Truth Social and to Public Square. One undisclosed customer accounted for nearly half of Rumble’s ad sales.

Pavlovski remains optimistic about a 2024 turnaround from election spending plus new programming and monetization opportunities. But the market still wants proof. The stock price – which in June hit a 2023 high of $11.25 – closed at $4.49, close to its low for the year of $4.33.

Salem Media Group

Stock price change: -62.9 percent

In late 2022 The New York Times called Salem Media “a conservative media juggernaut” – and that seemed appropriate.

The radio, digital, and publishing company offered some of the hard right’s most popular commentators including Sebastian Gorka, Eric Metaxas, Dennis Praeger, and Charlie Kirk. And it had just made its first foray into film with Dinesh D’Souza’s financially successful – but widely derided and debunked – 2,000 Mules which alleged that Joe Biden won the 2020 presidential election due to fraud.

Nobody would call Salem a juggernaut today.

It lost more than half its market value in 2023 and ended the year saying it will delist itself from NASDAQ after it failed to meet the marketplace’s requirement for companies to keep their stock prices over $1 a share. (Salem’s stock will continue to trade over-the-counter.)

What happened to Salem, which bills itself as “America’s leading multimedia company specializing in Christian and conservative content”?

About three-quarters of its revenue comes from radio, and it reported higher-than-expected losses in ad sales just as spending grew for new initiatives. Salem reported a net loss of $43.5 million for the first nine months of 2023 – down from a $1 million loss in the same period in 2022 — on revenues of $192.8 million, down 2.7 percent.

The numbers sent investors fleeing. Salem’s market value dropped about $11.5 million in 2023, leaving it worth just $10.6 million at year end. The business woes jeopardized Salem’s ability to meet its debt obligations with Wells Fargo. The companies reached a series of forbearance agreements to avoid default.

These were temporary remedies. Hungry for cash, Salem sold one of its crown jewels: the widely known but unprofitable Regnery Publishing, whose book authors include Ted Cruz, Metaxas, and Rand Paul. It also agreed to sell its church products business, and radio stations in Tampa, FL; Greenville, SC; and Sacramento, CA.

Salem ended the year with one hopeful sign: it lined up a three-year $26 million credit facility from Siena Lending Group to replace the one with Wells Fargo. Executives will have to pray that this reprieve, and a lot of election year ad sales, will restore investors’ devotion.

Right Wing Biz Watch is a ongoing series of articles examining the business and finances of right wing media. Its author, David Lieberman, covered the media business full time for 30 years at USA Today and other publications before joining The New School as an Associate Professor in its graduate Media Management program.

Interested in more news about right-wing media curated especially for mainstream audiences? Subscribe to our free daily newsletter.